How to Save More Money When You Have No Money to SAVE!

We have very little margin in our monthly budget, so when we want to splurge on a family vacation or any other non-necessity, the funds usually have to come from somewhere other than our paycheck. That might feel impossible, but here are 10 ways to boost your savings when money is tight.

This post may contain affiliate links. That means if you click and buy, I may receive a small commission (at zero cost to you). Please see my full disclosure policy for details.

SAVE YOUR RAISES

If you are fortunate enough to get a raise at any point, regardless of how much, use it to boost your savings fast. Instead of adjusting your standard of living, put away the difference. At first you can use this to build up emergency savings, and then when you have at least $1000 stashed away, you can either pay off debt with the extra or increase your retirement contributions. Just don’t give in to the temptation to spend more when you were able to live on less before! That’s the trick.

SAVE UNEXPECTED CASH

Same concept here. When you get an additional lump sum of money from an unexpected rebate, inheritance, tax refund, birthday, etc. resist the temptation to go to Target, and pad your savings instead.

Similarly, when any of us (kids included) get money for birthdays or Christmas, we try to steer them towards saving it for a bigger purchase instead of letting them pick out yet another toy at Target. Or if we have a family vacation scheduled we encourage them to save so that they have their own spending money.

SELL CLOTHES ON POSHMARK

In the last year I’ve made over $500 selling clothes I no longer wear. And it’s not just for women’s clothing. I’ve sold my husbands and my boys clothes as well. It’s really easy to get started and when you make a sale all you have to do is print out the prepaid USPS label and stick it in the mail.

I’ve even found that people are still buying during the quarantine. I just dropped off a package at the postoffice a couple of days ago so now is a great time to get started!

GET $10 WHEN YOU OPEN AN ACCOUNT! Open up your Poshmark account with my referral link and for a limited time get $10 off your first purchase of $10 or more.

CUT OUT ONE INDULGENCE FOR A MONTH

I’m all for indulging in things that are valuable to you, and I won’t pass judgement if your daily Starbucks is yours. But try picking one of the things you indulge in regularly and cutting it out for a month (or longer!) and put aside the money you would have spent. Who knows, you might see how much that adds up and change some of your spending habits long term!

TRY A NO SPEND CHALLENGE

Who’s up for a challenge? You can take this as far as you’d like. It can be as easy as not spending money on anything besides your monthly bills and groceries. Or you could even try to not spend money on groceries by doing a pantry cleanout month. Use up what is in your deep freezer and buried in the back of your pantry. Get creative! Whatever category or categories you choose, use the amount you save to boost your savings account instead.

RETURN THINGS THAT ARE STILL RETURNABLE

One of the ways people let cash slip through the cracks is by buying things that they end up not using, and just forgetting or choosing not to return them to the store. It might seem like that $5 here and $10 there aren’t worth making the trip to the store, but if you’re not going to use it, get your money back!

I’ve found that it helps to hang my returns on a doorknob that I will see as I’m heading out the door. It reminds me to take it to my car, which at least alleviates one barrier to getting it back to the store. Then as I’m running errands I’m more likely to see it and make a quick stop to return it.

START USING CASH BACK APPS

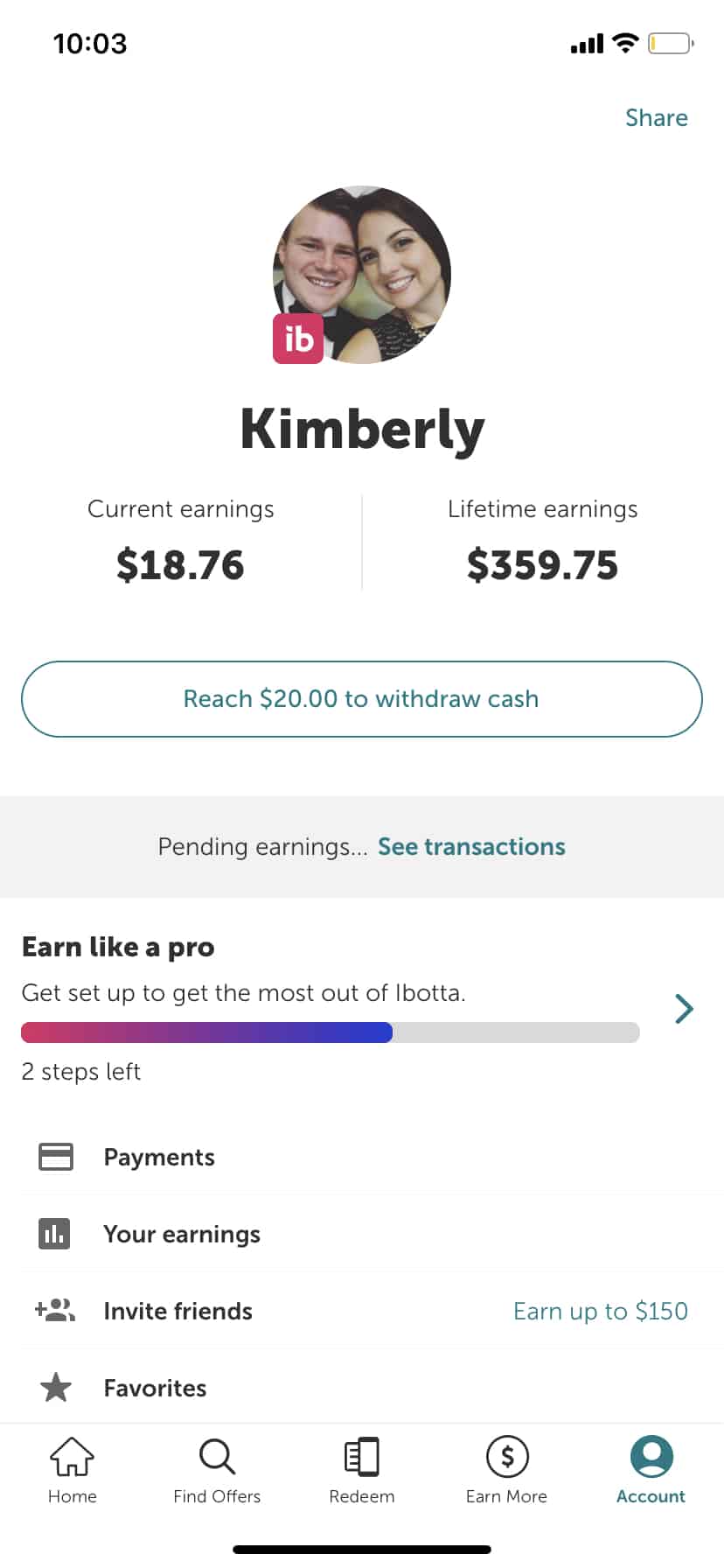

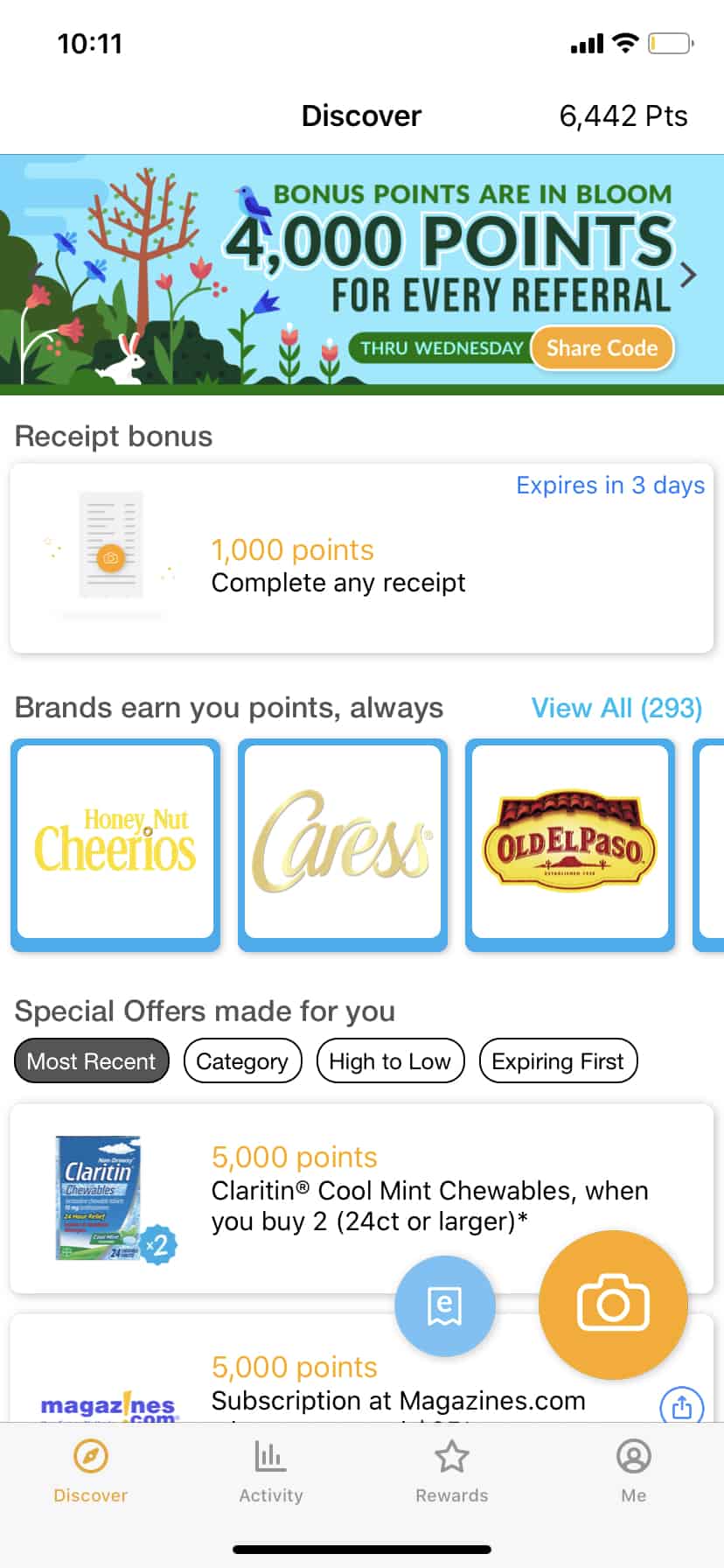

Are you using Ibotta yet? How about Fetch Rewards? If not, what are you waiting for!? You can scan the same store receipt on both of these apps to double dip on the savings. Ibotta takes a little bit of planning if you really want to maximize your rewards, but Fetch rewards you for simply scanning your receipt.

Another great rebate site to use is Rakuten (formerly Ebates). Install the plugin to your web browser and get alerts for which shopping sites have a cash back offer (sometime as high as 20% back!). You’ll definitely want to have this installed around Black Friday when there are extra bonus offers available.

Fetch Rewards

If you use my Fetch Referral code (U6NTW) you’ll get 2000 points ($2 value) to get you started!

Ibotta

And use this link to get a $20 bonus just for signing up ! Just be sure to redeem your first receipt in the first 7 days or you’ll miss out on the bonus.

Rakuten

Earn $25 for signing up and completing a qualifying purchase within 90 days of account opening when you use THIS LINK.

SET UP AUTOMATIC WITHDRAWALS

One of the ways I have found to easily put away money is to set up automatic withdrawals. I don’t have to think about it, I can pick whatever amount I feel comfortable with, and it forces me to stay on track to my savings goals.

Lately I’ve been using the Acorns app. Acorns is a spare change investing app that invests your money based on your age, time horizon, income, goals and risk tolerance. It has been the easiest way I’ve found to put away money every month without even trying. You can set up monthly withdrawals and have your change rounded up from everyday purchases.

You can use this Acorns referral link to have an extra $5 invested when you open your account.

SELL THINGS ON YARD SALE SITES

You better believe that the first time I heard about Facebook yardsale sites I was ALL OVER IT. It’s seriously the easiest way to make extra cash and it’s an introvert’s dream. I can post things like clothes my kids have grown out of, old toys, furniture, knick knacks, you name it. I arrange for “porch pick ups” where I leave the item on my front porch and people come to pick it up and leave cash under my doormat. In just the last month I’ve made $250 to put towards our food money for a future Disney World trip. Plus it gives me the drive to clean out my closets.

Just be sure to read each individual group’s rules for buying and selling as they will vary from group to group.

OPEN A NEW CHECKING OR SAVINGS ACCOUNT

I get several postcards in the mail each month offering anywhere from $200-$300 for opening a new checking or savings account. The trick here is to read the fine print to see what it requires and how long you will need to keep the account open in order to qualify. But usually they require at least 1 direct deposit a month and that you keep the account open and in good standing for around 3-6 months.

These kinds of things can take a little bit of organization but it’s possible to earn around $1000 in bonuses each year. Not bad!

$200 Chase Bonus

We bank mostly with Chase and have no complaints. If you use my referral link below (green button), you’ll get $200 for opening a Chase Total Checking account. Avoid the $12 monthly fee by doing ONE of the following each month:

- Direct deposit totaling $500 or more made to this account,

- OR a balance at the beginning of each day of $1,500 or more in this account,

- OR an average beginning day balance of $5,000 or more in any combination of this account and linked qualifying Chase checking, savings, and other balances

More Money Saving Posts

10 Habits of People Who Are Never in Debt

11 Habits of People Who Always Score the Best Deals on Everything

How to Turn Any Gift Card into Savings

I hope some of these ideas are helpful as you look for ways to boost your savings. There is money out there to be made if you put a little effort into making it happen! Let me know if I can help in anyway. Either leave a comment below or send me an email at info@vacationpointers.com.

Pin this for later!

8 Responses

Amazing tips!! Definitely all great reminders on areas where we can easily implement solutions

I need to try some of these tips

Great advice! I love no spend challenges! Also, those apps are fun! I’ve gotten plenty of Amazon gift cards from them! =)

Right? Who doesn’t love free money?

My sister’s done poshmark before, and it definitely worked out for her. Great tips!

Thanks! My sister is really into it too. She even combs through the racks at goodwill for things to sell. I don’t have as much patience :).

Great Tips! Thanks for sharing!

Thanks!