Southwest Companion Pass Promotion 2023

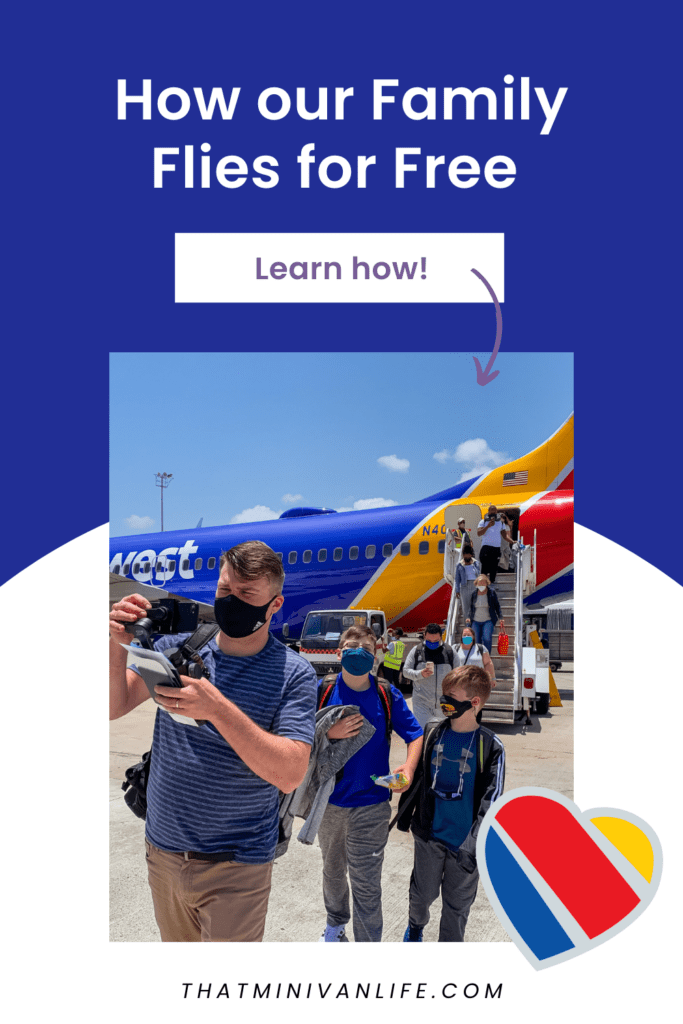

Want to hear something pretty cool? In the last 5 years our family has not paid for one single plane ticket. Now that would be easy if we hadn’t traveled anywhere, but nope! That’s not at all the case. In just the last 5 years we have flown to Costa Rica twice, the Dominican Republic, Cancun, Chicago, Charleston, California, Puerto Rico and Florida countless times. And for each of those flights our only cost was the taxes for each ticket. What’s our secret? It’s the Southwest Companion Pass promotion!

Part of our free flying is thanks to the Southwest Companion Pass trick. Southwest is our favorite airline for families for a lot of reasons (can you say family boarding and free bags?). But the biggest reason is the Southwest Companion pass that makes it possible for our family of 5 to only have to buy 3 plane tickets when we travel. So if you want to know how to take advantage of the Southwest Companion Pass promotion or how to use the Southwest Companion Pass, you’re in the right place! In this post I’ll cover how to get the Southwest companion pass, how to use it, and how to keep it!

Vacation Pointers is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The information for the Southwest Rapid Rewards Premier Credit Card has been collected independently by Vacation Pointers. The card details on this page have not been reviewed or provided by the card issuer.

Also, this post may contain affiliate links. That means if you click and buy, I may receive a small commission (at zero cost to you). Please see my full disclosure policy for details.

Southwest Companion Pass Offer

What is the Southwest Companion Pass?

The Southwest Companion Pass is essentially an unlimited Buy One Get One Free plane ticket for flights booked with Southwest Airlines. Anyone who earns this perk can book a flight (paid for with either cash or points) and then add a companion who flies with them on the same flight for the price of taxes, which for domestic flights is $5.60 each way.

How to get the Southwest Companion Pass

To earn the companion pass you’ll either need to fly 100 qualifying one way flights or earn 135,000 tier qualifying points in the same calendar year. Now unless you fly A LOT, it would be really difficult to earn it via actual flying.

However, the 135,000 points can be earned a few different ways. They can be earned through reward miles from flights you paid for in cash (not miles), through credit card sign up bonuses, through credit card referral bonuses (referring friends and family to their own cards) or points earned through Rapid Reward partners.

So which way do we earn it? You probably guessed it…

Credit Cards!

So which credit cards do I need to get the Southwest Companion pass?

As I mentioned above, to earn the Companion Pass you’ll need to earn 135,000 points in the same calendar year. That high number is easily achieved by combining the sign up bonuses from 2 Southwest Credit Cards. It can be a combination of one personal Southwest credit card and one business Southwest credit card or 2 Southwest business cards.

You can have more than one Southwest business card at a time, but you can only hold one Southwest personal card at a time. Southwest will also give you an honorary 10,000 points toward the companion pass just for having a Southwest credit card bringing the total amount of points needed down to 125,000.

Now, which 2 Southwest cards you decide to apply for is up to you! Here are your choices:

Southwest Business Cards

- Southwest Rapid Rewards® Performance Business Credit Card

- Southwest Rapid Rewards® Premier Business Credit Card

If you decide to go the personal and business card route, you can apply for the personal and business cards in any order, but we prefer to start with the business card because of the higher minimum spend required. The business card will give you the biggest point boost towards qualifying for the companion pass. Business cards also don’t count toward Chase’s 5/24 rule, but you do need to be under 5/24 in order to qualify… which is another good reason to apply for this card first.

The Southwest Rapid Rewards Premier Business card has a $99 annual fee and comes with a 60,000 point bonus after spending $3000 on the card in 3 months.

The Southwest Rapid Rewards Performance Business card has a $199 annual fee and comes with an 80,000 point bonus after spending $5000 on the card in 3 months.

The biggest perks that we see as potentially worth the higher $199 annual fee for the Performance card are:

- 20,000 additional bonus points

- $100 credit towards Global Entry or TSA precheck every 4 years

- 4 upgraded boardings per year (worth about $30 each)

- 9000 anniversary points

- Up to 365 in-flight wifi credits on Southwest flights (worth $8 per login and you can use more than one per flight).

Personal Southwest credit cards

As of the time of posting this article, all personal cards earn the same sign up bonus of 50,000 points after spending $1000 in 3 months plus.

The only significant differences between the cards are the annual fees and the amount of anniversary points you will recieve (points added to your Rapid Rewards account each anniversary of opening the card). So it’s up to you to decide if the additional anniversary points are worth the increased annual fee.

Southwest Rapid Rewards® Plus Credit Card

- 3,000 bonus points on each cardholder anniversary

- 2 EarlyBird Check-In® each year

Southwest Rapid Rewards® Premier Credit Card

- 6,000 bonus points on each cardholder anniversary

- 2 EarlyBird Check-In® each year

- No Foreign Transaction Fees

Southwest Rapid Rewards® Priority Credit Card

- 4 Upgraded Boardings per year when available

- $75 Southwest® travel credit each year

- 20% back on inflight drinks and WiFi

- 7,500 bonus points on each cardholder anniversary

Any of these cards will get you the points you need to hit the companion pass threshold. We usually go with the card that has the $69 annual fee, but the $149 annual fee card has the $75 Southwest credit so it essentially makes them the same cost.

When should I apply for these Southwest Credit cards?

The best time to apply for these cards is late October through mid November. The reason being that if you time it right and your welcome bonuses don’t credit to your account until early in a calendar year, then you will have the Companion Pass for almost 2 full years. Southwest will award you with a companion pass for the remainder of the year in which year earn 135,000 points plus the entire following year.

So because you want your sign up bonus to credit in the following year, it’s really important to not meet your minimum spend until January at the earliest. If you earn 50,000 points in December and 80,000 points in January, those 50,000 points will NOT count towards your companion pass. And that would just be sad. Like, really really sad.

So theoretically you could apply for the business card in late October and begin working towards your minimum spend and stop using it when you get close. Then apply for a personal card in November and stop using it when you get close to that minimum spend. THEN when January comes around finish up the rest of your spending on both cards so that your bonuses hit at the end of your next statement period.

So if you get a personal card that earns 50,000 points and a business card that earns 80,000 points (the one with the $199 annual fee) and then add in the points you will earn just from spending the minimum spend, you should have at least 137,000 points!!

** It’s important to note that you do not need to “cash in” those points for the companion pass. You earn the companion pass AND you get to keep those points you’ve earned to book flights!!

How to Earn 2 Companion Passes with 3 Credit Cards

- In mid December (no earlier), Player 1 opens a Southwest Business Performance Card for 80,000 points but does not finish the minimum spend until January.

- Anytime after that (depending on how quickly you can finish the minimum spends), Player 1 refers Player 2 to a Southwest Business card for 80,000 points. Player 1 will receive 20,000 referral points.

- Then Player 1 refers Player 2 to a Southwest Personal card for 50,000 points. Player 1 will receive another 20,000 referral points.

- Both Player 1 and Player 2 need to WAIT to finish their minimum spend requirements until January.

If all goes according to plan, Player 1 should have a total of 125,000 points (80k from business card bonus + 5k from spending + 40k for referrals) and Player 2 should have 136,000 points (80k from business card bonus + 50k from personal card bonus + 6k from spending) and you should end up with 2 companion passes for your family with 3 sign up bonuses!

Because Player 1 is depending on the points earned from meeting the minimum spend on the Performance Business card, you’ll want to make sure you don’t open this card until mid December when you’re sure that your statement will close in January. This will ensure that those extra 5000 points hit your Southwest account in the year you need them too.

How to use the Southwest Companion Pass

How do I add my companion on Southwest?

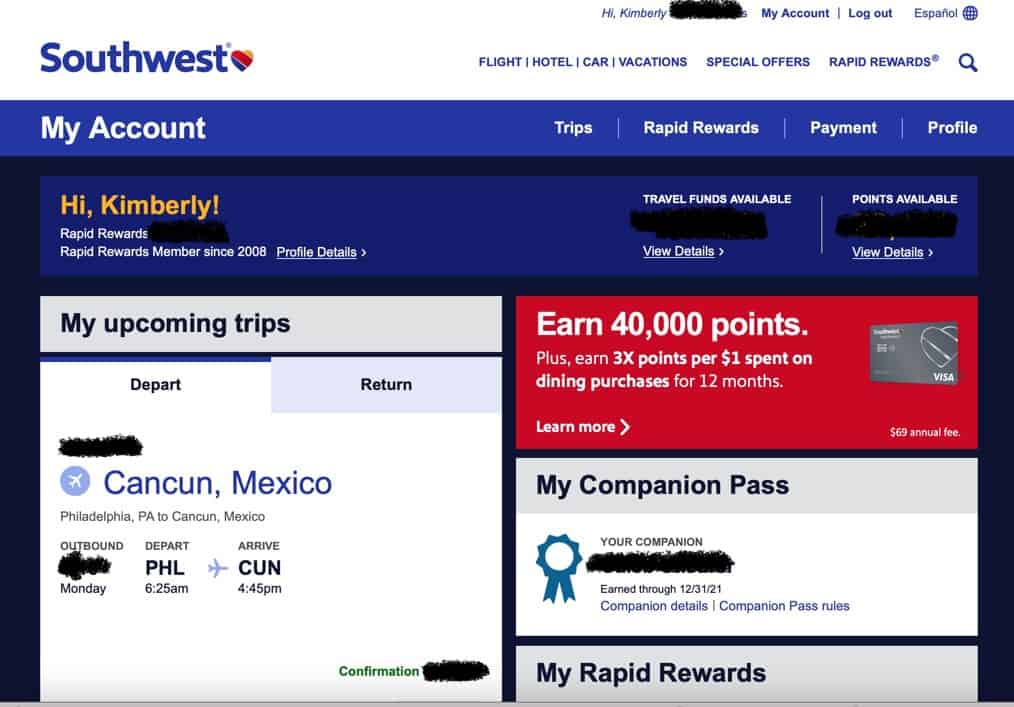

To designate your companion just log into your Rapid Rewards account on Southwest.com and click on My Account at the top of your screen. If you are eligible for the companion pass you should see a section in your profile that says “Choose Your Companion.”

How to book a companion pass fare

This part is super easy. Once the person who has earned the companion pass has booked their own flight, just go to your account page and then look under “My upcoming trips.” On the bottom right hand corner of this box, you will see “Add Companion.”

Then all you have to do is follow the prompts, pay the taxes for your companion’s flight, and you’re all set!

Does the Southwest Companion Pass work with points?

Yes! This is the beauty of having a companion pass. Not only are you earning all of those points in the process of qualifying, but you get to keep those points to book your flights. Then once you have your reward trip booked you can name a companion. Your hard earned points go twice as far!!

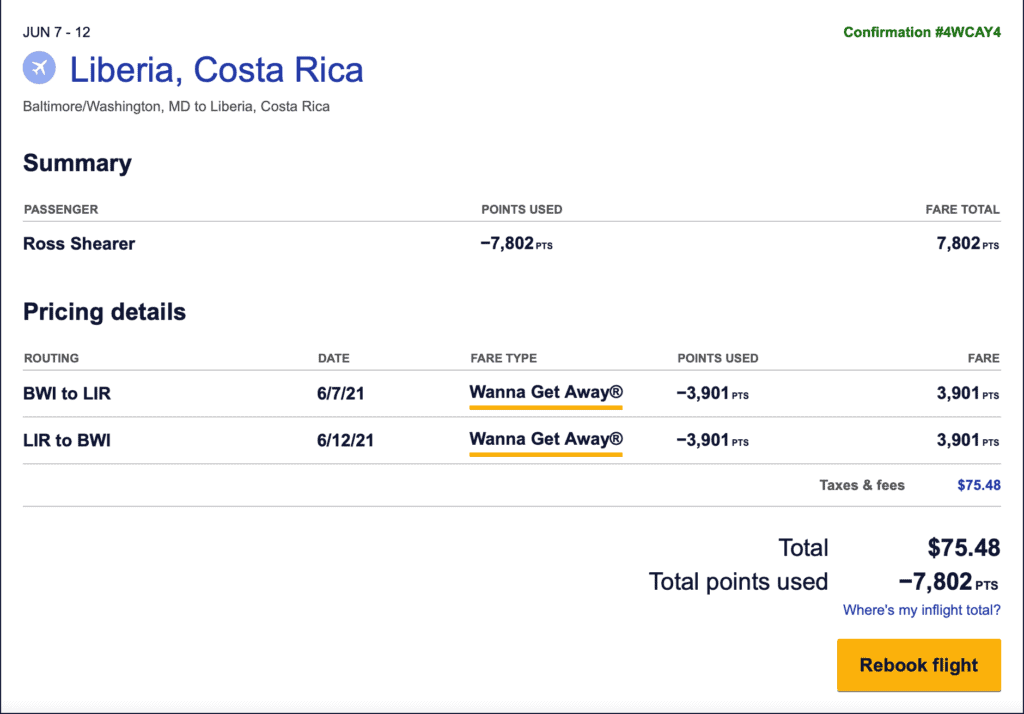

Especially when you can find a super cheap flight like we did a few years ago to Costa Rica. When flights first opened back up in early 2021, there were some amazing deals to be found. We were able to book direct fights to Liberia, Costa Rica for just 3,901 points each way plus tax. That low price coupled with our companion pass made for an EPIC deal.

How much are Southwest points worth?

Some airlines charge a set amount of points per flight based on distance or time of travel. Southwest, on the other hand, sets their point prices based on the cash price.

On average Southwest points are valued at 1.4 cents per point. But if you’re like me and learn better from visual aids, here are some screenshots comparing points vs cash prices for the same route to get a rough idea of how much value you can get from your Southwest points.

Southwest Companion Pass Extension

So after spending all of that time and effort earning it, you may be wondering how to keep the Southwest Companion Pass. As I mentioned earlier, your companion pass is valid for the remainder of the year in which you earned it, plus the entire following year.

Technically you can extend the length of your companion pass by meeting the criteria we went over above (lots of flights, lots of spending on Southwest cards, etc.). But the easiest way to keep your companion pass is by repeating this process over again in 2 years.

The current fine print allows for customers to receive the signup bonuses from Southwest credit cards every 24 months. So if you want to do this, be sure to check your statements to see when you received the sign up bonus and confirm that 24 months have passed.

You also need to make sure that your credit card has been closed. If you are interested in earning the bonus again on a particular card, just be sure to close it about 2 weeks before you apply.

Does a Southwest Companion have to be the same person every time?

The quick answer is NO. Southwest allows you to change your companion 3 times in a calendar year. So if you plan an anniversary trip with your husband in the spring but then want to go visit family with one of your children, you are allowed to change your companion for that trip. In our family we try to be strategic as to when we schedule trips so that we can get the most value out of our companion pass throughout the year.

How to change a Southwest Companion

Unfortunately, there is no way to change your companion online. To change your companion you will have to call Southwest customer service. Thankfully, minus your time on hold, the process is relatively painless. The representative will likely remind you that this is the first time you have changed your companion this year and that you are able to change it again 2 more times. And while their website will tell you that there could be a 21 day waiting period, in our experience the changes have always been instant.

Southwest Credit Card Customer Service

To change your Companion Pass designation, call 1-800-435-9792.

Conclusion

Well, that should cover it! This Southwest Companion Pass trick has literally saved us thousands of dollars and allowed us to fly with our whole family several times a year. Earning it does take a little bit of strategy and organization, but I can attest that the benefits are beyond worth your time!

If you still have questions please leave them in the comments. Or for a complete list of companion pass rules and regulations you can visit Southwest’s website.

More on Our Family’s Free Travels

- Hyatt Andaz Costa Rica Review

- Costa Rica with Kids: A 10 Day Itinerary

- Points and Miles for Beginners: How to Take Your Family on Vacation for Free

- 5 Reasons Travel with Young Kids is Worth the Headache

- How to Survive Airport Security With Kids

- Dreams Macao Beach Punta Cana Review

Pin this for later!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

6 Responses

New follower here!!

So you mentioned in this blog that “ You also need to make sure that your credit card has been closed. It does not matter how long the card has been closed, just that it is not currently active when you apply.”

My question with this is, if you close the credit card, don’t your points disappear?

I got the southwest rapid reward plus card maybe about 3 years ago. You’re saying I’d have to close that personal credit card and reapply to get the sign up bonus again. If I do that, wont that erase the history of having that cc and hurt my credit score?

Could I upgrade my card to the Personal SW premier CC instead of cancelling?

I have just always heard that you don’t want to cancel credit cards, just downgrade to the $0 annual fee card and keep the balance at zero.

Also, do you have to have a business to apply for the business cc? Or could you do a personal cc in November wait 90day and apply for the next level up personal cc?

Hi! Once your points are credited to your Southwest Rewards account they are no longer connected to your credit card. So if you close the credit card your points will be safe and sound! Normally you would want to downgrade a card if possible, but since there are no “no annual fee” Southwest credit cards and you cannot have more than one personal Southwest Credit card, your only option is to close the card and reapply. Hope that answers your questions!

I noticed above that Brittney asked if you have to have a business to apply for the business credit card? – I was wondering the same thing

You don’t need a business in the sense that you might think. To qualify for a business card you really just need some kind of side hustle that makes a little extra income. When I opened my first business credit card my business was reselling my kids toys on facebook marketplace. So the good news is, if you think you don’t qualify, you probably do!

Can I get the companion pass once I earn the points through the business credit Card? Or do I have to get a personal credit card as well?

Most people will need both card bonuses in order to earn enough the 125,000 points required in a calendar year. But you can also do it with 2 business cards, or 1 business card and 2 referral bonuses. You just can’t open 2 personal cards within 24 moths of each other. Whatever it takes to get to the 125k will do the trick!